Best Position Size Calculator: Tutorial and Download

Updated: Feb 18, 2021

When it comes to Forex trading, knowing exactly how 'big' or 'small' your risk should be on each trade is important as predicting the direction of the trade itself.

This is where understanding how to position size correctly is imperative to your trading success.

In this article, we will cover:

The concept of position sizing with "Lots"

How to properly manage your trades in Forex.

Explaining what margin is in forex.

The hidden truth about your brokers' agenda behind leverage.

Giving you a guide to how much money you will need to start your trading journey.

Position Sizing with Lot Sizing

The general definition of lot size:

"Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing."

But how does this apply to FOREX?

Currency Units tell us how much currency we are going to buy or sell in the market. Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell.

If you buy a currency with a 1 lot size you are purchasing 100,000 units of that currency.

Naturally, if you want to become a successful trader you must know this information and be able to apply it on a daily basis...

Don't panic though, we will explain it in detail soon enough, plus, we have lots of different resources to help you along the way...

The different lot sizes

How do lot sizes help my Trading?

The forex lot size that works well for you is really dependent on a number of factors based on how you want to trade.

You need to know how much money you will be trading with, this is called capital.

Risk management is key when using lot size as you need to be able to maintain your positions. you need to know how much of your capital you actually want to risk at any one time.

At Logikfx we would recommend no more than 3% but the decision is ultimately yours.

If you purchase too many units of a currency this may become overwhelming for your account and it will be shut down by your broker.

Leverage is a key factor in working out the best lot size for you as it allows you to effectively borrow money and inflate your capital allowing you to buy more currency, however, leverage can be very dangerous as we will explain further down the article...

Proper trade management in FOREX

Here I will show give you an example of how all these factors come together in an actual trading scenario...

Key definitions that you will need to know for this example

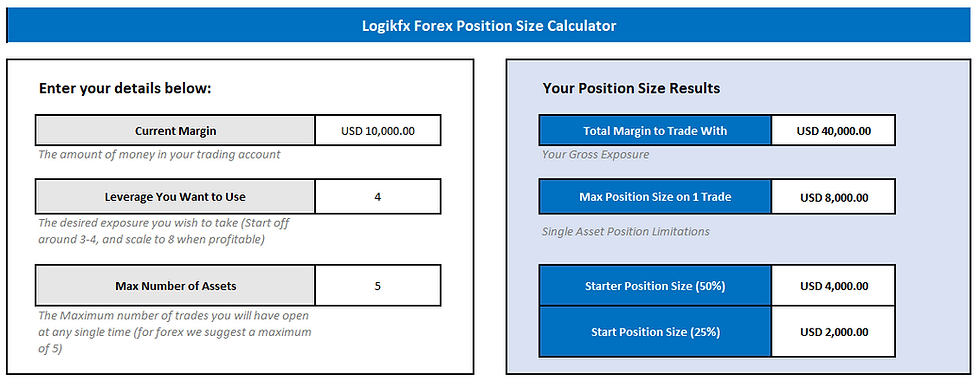

Logikfx Position Size Calculator Excel Tutorial

What is margin?

Margin is the amount of money a broker wants you to put down in order to use leverage, like a deposit.

"Margin is not a cost or a fee, but it is a portion of the customer's account balance that is set aside in order to trade."

Highlighted in the red box above is where the position size calculator will show your margin.

What is a margin call?

key definitions for the types of margin

The Margin call is effectively a warning sent out by your broker, they will notify you that you do not have the appropriate free margin to maintain you positions.

This means that you "Initial margin" is about to be wiped out i.e. your "variable margin" exceeds you "initial margin"

What is leverage?

As explained earlier Leverage is the use of borrowed money (called capital) to invest in a currency.

The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade much larger positions in a currency. As a result, leverage magnifies the returns incredibly you bias on a currency is correct.

In the position size calculator your leverage is displayed in the highlighted box, you can change this at any time but we recommend a starting leverage of 3-4:1 and moving up as you get better and more experienced.

The truth about leverage

Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. Leverage is a double-edged sword and while it can help you generate enhanced gains; it can also accelerate your losses.

In the foreign exchange markets, leverage is commonly as high as 100:1. This means that for every $1,000 in your account, you can trade up to $100,000 in value. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds.

Retail traders often use very high leverage to profit from relatively small price changes in currency pairs.

Can you see the problem there?

Well, if you are using very risky amounts of leverage in your trading to profit over fast but small moves in currency then the potential for you account to be closed out due to a margin call is increased significantly.

"Its just not responsible to trade with huge amounts of leverage to supplement small amounts of capital, the risk is just too great!"

If you plan on using leverage while you are trading the forex markets you need to have a complete understanding of the benefits of investing with borrowed capital, luckily your reading this article!

There are hidden agendas behind leverage, despite what you may hear or read online leverage is not actually there for your benefit!

Even though it seems like a really useful tool, allowing you to make huge amounts of money without having to have a huge account balance, there is a hidden reason why brokers offer such high leverage to their customers.

We call this the 90/90/90 rule, this is the fact that...

Whenever you open a position with your broker they take the opposite side of that trade, beaning that if you buy a currency they will sell the currency at the same time, so if your profit where to increase by 2% the broker would be at a loss of 2%.

After reading that can you tell why brokers offer Traders such high amounts of leverage?

Retail traders often trade with low volatility and high liquidity due to the fact they need to make money off of small movements in the markets, they use these huge amounts of leverage to increase their liquidity (capital) by very risky amounts.

The Wrong way to Use Leverage

Leverage is usually given in a fixed amount that can vary with different brokers. Each broker gives out leverage based on their rules and regulations depending on a number of factors including what part of the world the business is registered in.

The amounts are typically 50:1, 100:1, 200:1, and sometimes even 400:1.

This is the type of leverage that retail traders will take advantage of to increate their revenues without the need for huge amounts if initial margin.

Beware of any broker who offers this type of leverage for a small account. Anyone making a $300 deposit into a forex account and trying to trade with 400:1 leverage could be wiped out in a matter of minutes.

Can you see the problem here?

How The Pro's use Leverage

Professional traders usually trade with very low leverage. Keeping your leverage lower protects your capital when you make trading mistakes and keeps your returns consistent.

Many professionals will use leverage amounts like 10:1 or 20:1. It's possible to trade with that type of leverage regardless of what the broker offers you. You have to deposit more money and make fewer trades.

At logikfx we recommend starting out using leverage of 1:4, this will mean that you returns are small however it is the best possible way to start trading as you potential downside is very small, eventually you can work up to using higher leverage once you trading strategy is established and you have more capital at you disposal!

You must remember that just because the leverage is there, does not mean you have to use it. In general, the less leverage you use, the better. It takes the experience to really know when to use leverage and when not to. Staying cautious will keep you trading for the long run, and minimise the risk of you getting a Margin call.

How many trades should you open at the same time?

The position size calculator shows the highest number of assets that you can have open at once in the highlighted box. You can change this number if you wish but we recommend that you hold between 3-5

Here at logikfx we believe that you should only ever old between 3 and 5 trades at any given time, this is to make asset management easier and allowing you to conduct analysis much easier.

There is another reason however, no Broker will allow you to open a position with below 1,000 units of currency or a 0.01 lot size.

look what happens if we change the number in the highlighted box!

As you can see if we where a reckless trader and tried to open more assets than recommended we could not open up any positions only buying 570 units of currency, we would have to increase our leverage by a lot to do this and that is very irresponsible!

What is gross exposure?

Your Gross exposure is the amount of money that you are trading with when using leverage, it is calculated with a simple formula:

How to choose the right position size

The above highlighted sections are potentially the mot important in the whole calculator, here the position size calculator will tell you how many units of each currency you should buy or sell.

You are given 3 sizes: 25%, 50% and 100%.

these options are a part of trade management and this is called scaling in, you start by entering 255 of you full position max, after the trade have started to move in the desired direction you buy more units of currency to equal 50% of you max position limit for 1 asset, after you bias has performed well then you increase the position size to 100% by adding more units of currency to equal this limit.

Your maximum position size is the total amount of currency units you can buy for one trade, depending on your leverage and number of assets this number will change accordingly, for example:

How much money do I need to start trading?

At logikfx we recommend that you start trading with $4,000 of margin, this will allow you to have good starting leverage and it will mean when holding 4 positions it is not overwhelming but is not restricting, also you starting positions are fairly manageable and the smallest possible to minimise you downside.

The smallest margin you could start trading with is $1,000, however, here at logikfx we do not recommend this as your margin as it will only allow you to open 1 trade which is very restrictive, it does not diversify your portfolio so there is an increased risk with this small of an account.

This is an example of a very comfortable situation for any trader you can put up this kind of margin, it is not essential to have this much but this level of margin would offer you maximum freedom with your trading, you would be able to maximise profits with high position starts and you would be able to have a diverse portfolio.

Conclusion

Do not fall for the tricks of the brokers trying to squeeze every drop of commission out of you, you must understand how to manage leverage and not make the same mistakes that a lot of traders make by taking advantage of leverage and eventually doing too much!

"My advice would be to educate yourself, use sensible risk management and lot sizes and keep up manageable leverage and watch your profits grow and grow!"

Still learning how to trade? Learn through Logikfx Investment and Trading Academy (LITA) and take the first steps into growing your value as a trader with our free online courses, webinars, seminars. All from a small team of highly skilled traders with over 15 years’ experience in the financial markets. Learn how to make money trading forex, alongside the best ways to manage your risk through a proper trading journal, and sensible approaches to setting a stop loss (that doesn't get hit)!

Already know how to trade? Save hundreds of hours each month on trading technology, analysis and research using Logikfx's Macro Technology in the LITA Portal. Computing thousands of fundamental reports for over 23 economic regions, you'll know accurate currency strength at the click of a button.

Hi everyone, are you looking for a professional binary, forex and Bitcoin broker/manager who will guide and help manage your trade and help you earn meaningful profits all within seven days? Contact Mr Barry Silbert now for your investment plan. For he has helped me to earn 10,250 USD just with a little investment capital and with the aid of his trading software system that brings forth good trading signals i was able to trade and cash out on time and am still trading with him, if you need his assistance on how to recover your lost investment in bitcoin/binary Contact him now on whatsaap +447508298691. or contact him on his email address Email: Barrysilbert540 @ gmail. com. [WITH MR…