NZDJPY Analysis (Sep, 2022) Tourism Boost for NZD

- Matthew Cheung

- Sep 19, 2022

- 4 min read

New Zealand was one of the countries around the world which managed to control the pandemic quite effectively, blocking travel to reduce the spread of the virus... now that the vaccination programme has kicked off and borders are open New Zealand is booming...

"Increased spending on travel and leisure driven by eased Covid restrictions has helped helped New Zealand dodge recession, with its economy growing 1.7% in the quarter that ended in June." - The Guardian

Lets see how the economic date has played out since the and what we can expect moving forwards.

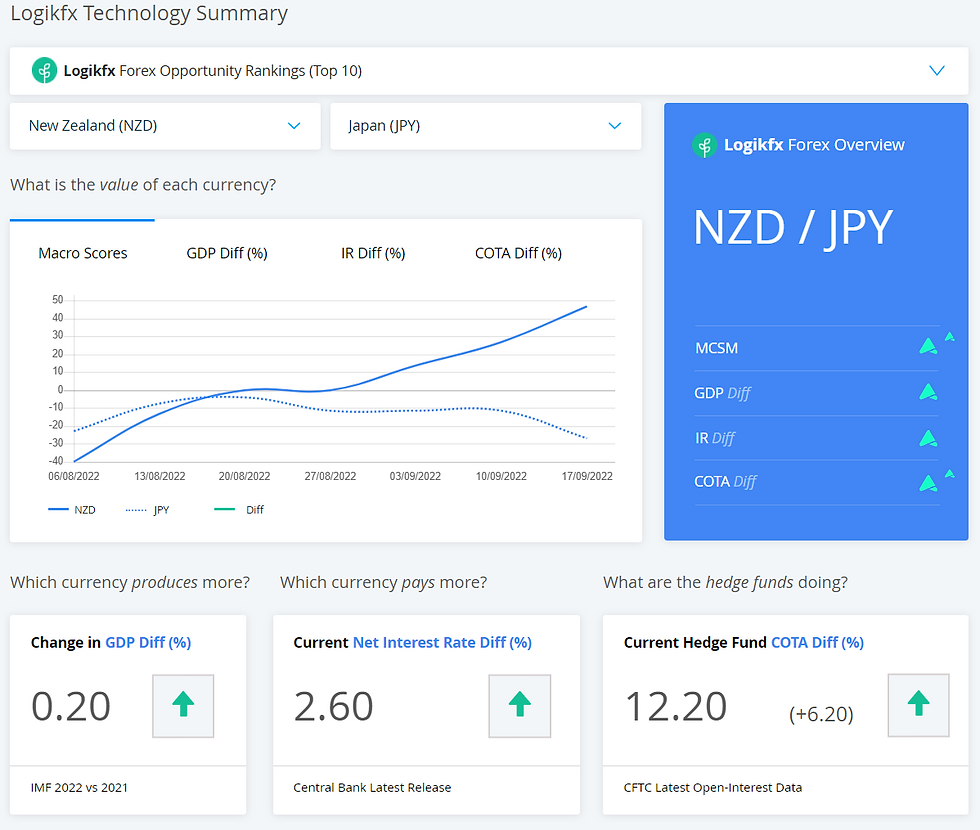

Technology Summary

Overall the technology summary page gives us a high level indication of the economic data and overall fundamental trends.

In this case we can see the major economic indicators:

Macro currency strength meter

GDP differentials

Interest Rate Differentials

Hedge Fund Positions

These are all showing bullish signs for the NZD and bearish for the JPY, overall creating a fundamental bearish direction based on the data.

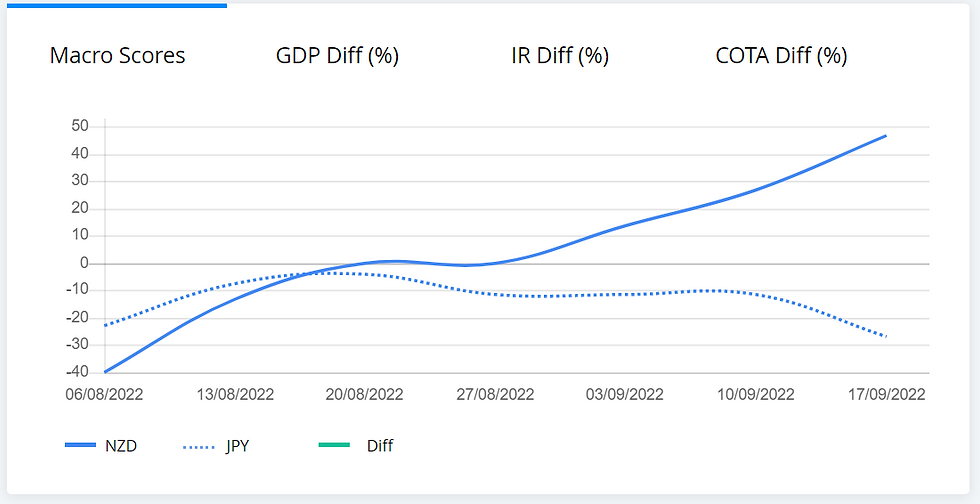

Currency Strength Meter

The Currency Strength Meter has shown significantly bullish signs for NZD over the past month and maintained bearish signs for JPY.

This is a significantly strong indicator as the currency strength meter from Logikfx analyses many economic reports and spits out the results above. In this case we can move forwards with a bullish outlook on NZDJPY from a fundamental perspective and see if the rest of the analysis holds the same bias.

GDP Differentials

The GDP Differentials are showing additional bullish signs for NZDJPY as the JPY dotted blue line is starting to show a steeper GDP growth rate meaning it's looking to slow down at a faster pace than New Zealand.

This means in the long term we could see an upwards shift in New Zealand's growth rates in comparison to Japans which would be bullish for the exchange rate.

Trade Analysis

GOLD prices are a commodity we've analysed against NZDJPY, mainly due to the safe haven status gold has vs the riskier status NZD has. What we saw between late 2021 and early 2022 was a strong positive correlation.

This meant as the prices of Gold increased we saw NZDJPY increase in price too... now that we're deeper into 2022 this relatonship seems to have fallen through with NZD increasing in price significantly but the Gold prices dipping.

This may have been due to more speculators investing in Gold and offloading their investments throughout the duration of the war in Ukraine.

AIR NEW ZEALAND is one of New Zealand's top companies in their country, throughout the past 2 years it has been a turbulent performance with prices dipping and rocketing respectively throughout both the pandemic and war in Ukraine.

Now we're seeing the prices of AIR fall due to potential inflation pressures, higher interest rates and these cost of living factors having pressures on consumers spending habits (less people taking airplanes/ holidays as they have less disposable income).

This has had a big impact overall, throughout 2020-21 we saw AIR have a positive correlation against NZDJPY but now we're seeing AIR prices dip throughout 2022 but NZDJPY increasing in price. This most recent negative correlation suggests that the dip in AIR may show an increase in NZDJPY soon... definitely one to watch out for.

TOYOTA prices are another company we've selected as it's one of Japan's top car manufacturers and exporters in the world. This means their purchases and sales across the worlds which amount to billions have a big impact on exchange rates and the transfer of different currencies in the the JPY.

What we've found from NZDJPY is that it's got a positive correlation against Toyota.

The most recent date shows that Toyota ha been fairly stagnant the past few months and potentially facing similar inflation impact as other companies across the world.

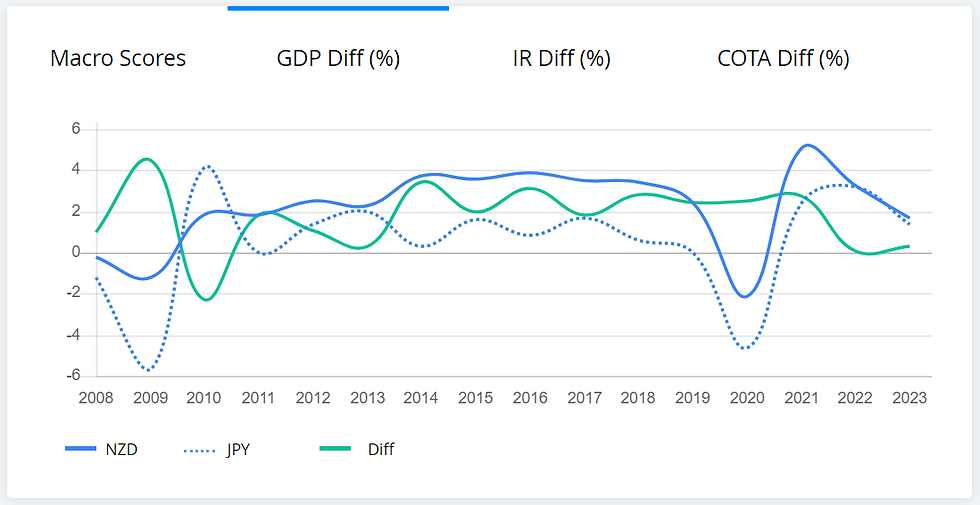

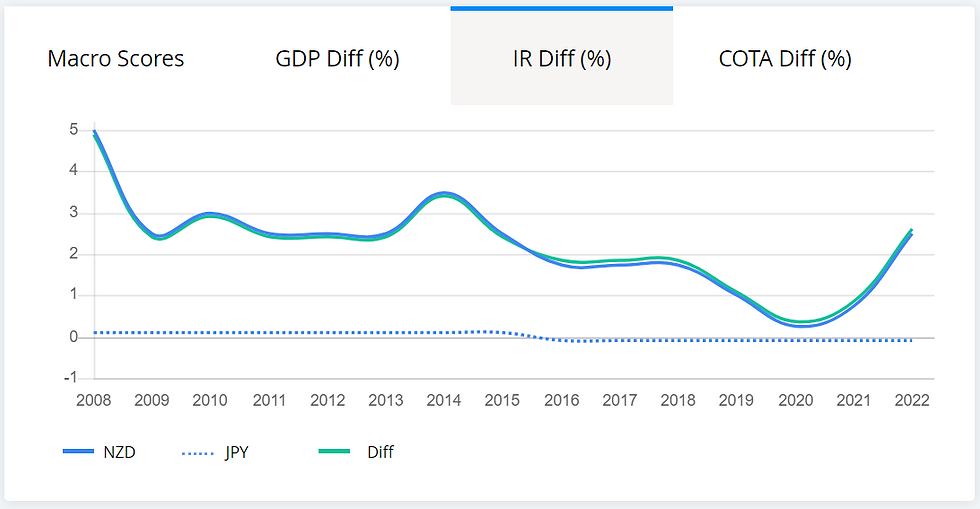

Interest Rate Differentials

The interest rate differentials are also showing positive signs for NZDJPY as New Zealand is set to steadily increase rates over the next year currently sitting at 3% in comparison to Japan's ultra low rates.

This suggests over the next year or so as central banks increase rates in New Zealand this gap will increase and the differentials will increase meaning more bullish momentum for NZD...

Hedge Fund Positions

The hedge fund positions are one of our final indicators in the analysis to check after the main fundamental factors. In this case we've seen the hedge funds start to increase their sell positions on JPY whilst maintaining their positions on NZD...

What we'd want to watch out for here is the solid blue line going up as this would indicate that hedge funds are starting to increase their momentum on long positions on the NZD which would indicator the market is trading in the bullish direction.

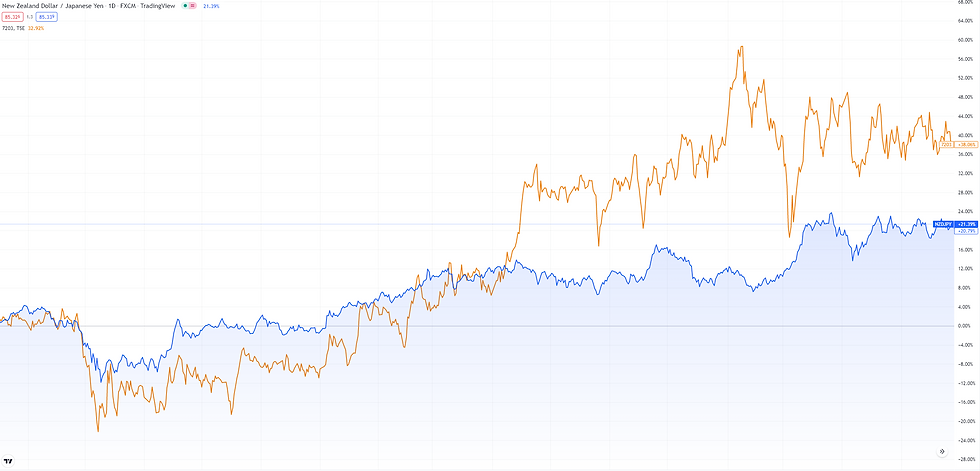

Price Analysis

Throughout the analysis we've found a strong bullish trend and the prices analysis is currently showing a large bullish trend has been brewing over the year...

Very recently the peaks of NZDJPY have been broken creating a new higher high early Sep.

In this area I would be looking for any technical signs for bulls entering the markets or new higher lows forming to signal a potential continuation.

Comments