Top Investment Apps for Forex Traders

The world of investing is continually evolving, having access to the right tools and platforms is essential for traders at all levels, whether you're a beginner learning the ropes or a seasoned professional. Investment apps have grown in popularity due to their user-friendly interfaces, accessibility, and advanced features tailored to different investment needs.

For forex traders, choosing the right app can streamline your trading process, provide valuable insights, and help you manage your portfolio effectively. Throughout this article, we’ll cover some of the top investment apps available to download right now, outlining their key features and suitability for different types of traders.

Quick Look:

Why Choosing the Right App Matters for Forex Traders

In the forex market, where timing and accuracy are everything, the app you use can make or break your trading strategy. Choosing the right app means finding a balance between user-friendliness, access to advanced tools, and market insights. For beginners, apps like Robinhood or Public.com provide an easy-to-navigate platform, while more experienced traders might opt for TD Ameritrade or Fidelity for their advanced features. Read on for an in depth round up on the best trading apps available right now!

Logikfx's Top 8 Investment Apps for Forex Traders

1. Robinhood: Simple and Commission-Free Trading

Robinhood is a popular choice for beginner traders looking for a simple and user-friendly platform. Known for its commission-free trades, Robinhood allows users to invest in stocks, ETFs, options, and cryptocurrencies. Although it’s a more generalised investment app, it provides a good starting point for those dipping their toes into forex trading.

✨ Key Features:

Commission-free trading

Access to stocks, ETFs, options, and crypto

Fractional share investing

👍 Best for: Beginners looking for an intuitive platform with commission-free trades.

💭 Considerations: Robinhood lacks the advanced charting tools and research options that more experienced traders may require.

2. eToro: Social Trading for Forex Enthusiasts

eToro stands out for its social trading capabilities. It allows you to observe and copy the trades of more experienced traders. For forex traders, this offers a valuable opportunity to learn from others while actively participating in the market. eToro also provides access to a wide range of asset classes, including forex, stocks, commodities, and cryptocurrencies.

✨ Key Features:

CopyTrader: Mirror trades from top traders

Commission-free for stocks and ETFs

Wide asset class variety

👍 Best for: Traders looking to learn from and copy expert traders’ strategies.

💭 Considerations: Higher fees on certain trades and limited research tools compared to other apps.

3. Acorns: Micro-Investing for Passive Income

Acorns is a micro-investing app designed to help people invest their spare change. While Acorns is not specifically tailored for forex trading, it offers a great opportunity for new investors to get started with passive income generation. It rounds up purchases and automatically invests in a portfolio of ETFs.

✨ Key Features:

Micro-investing with automatic round-ups

Managed portfolios tailored to user preferences

Educational resources for beginners

👍 Best for: Beginners looking for a simple, hands-off approach to investing.

💭 Considerations: Limited investment options and charges a monthly fee that may not suit those with small balances.

4. Wealthfront: Robo-Advisor with Advanced Portfolio Management

Wealthfront offers an automated, hands-off approach to investing through robo-advising. While it is not solely focused on forex, Wealthfront is ideal for traders looking to invest in multiple asset classes, including forex, while receiving automated portfolio management and tax-efficient investing strategies.

✨ Key Features:

Goal-based investing with automated portfolio management

Access to diverse financial products, including forex, stocks, bonds, and ETFs

Low management fee of 0.25%

👍 Best for: Long-term investors seeking automated financial planning.

💭 Considerations: No direct forex trading, and it lacks the ability to actively trade individual assets.

5. Fidelity Investments: Research-Driven and Comprehensive

Fidelity is one of the best investment apps for forex traders who need access to robust research tools. Fidelity provides commission-free trading on U.S. stocks, ETFs, and options, and it boasts a comprehensive platform that offers in-depth research and analysis, making it ideal for seasoned traders.

✨ Key Features:

Commission-free stock and ETF trading

Access to a range of investment tools and educational resources

Advanced research tools for in-depth analysis

Available for Apple Watch for on-the-go trading!

👍 Best for: Intermediate to advanced traders who require detailed market analysis.

💭 Considerations: While powerful, the platform may be overwhelming for beginners.

6. M1 Finance: Customisable Portfolios with Automation

M1 Finance offers a unique combination of self-directed trading and automated investing. It allows you to customise your own portfolios and offers commission-free trading, making it an excellent choice for traders who want more control over their investments while benefiting from automation.

✨ Key Features:

Create custom portfolios or use pre-built options

Commission-free trading

Fractional share investing

👍 Best for: Investors looking for a hybrid approach to automated and manual trading.

💭 Considerations: Limited research tools and no direct access to mutual funds or crypto trading.

7. Public.com: Social Trading with No Hidden Fees

Public.com combines commission-free trading with a social platform that lets users follow other investors, share insights, and build community-driven investment strategies. With a focus on transparency, it’s a strong competitor for traders who value collaboration while maintaining control over their trades.

✨ Key Features:

Zero commissions on trades

Social trading platform with community engagement

Supports fractional shares

👍 Best for: Investors looking for a commission-free, community-driven experience.

💭 Considerations: Limited investment options compared to other apps and minimal research tools.

8. Charles Schwab: Advanced Tools for Serious Traders

Charles Schwab (formally TD Ameritrade) offers one of the most comprehensive platforms for both beginners and advanced traders. For forex traders, the app’s Thinkorswim platform offers advanced charting tools and a wealth of technical indicators. Additionally, the app offers educational content to help users expand their knowledge.

✨ Key Features:

Thinkorswim platform for advanced charting

Access to forex, stocks, ETFs, options, and mutual funds

Commission-free trades for U.S. stocks, ETFs, and options

👍 Best for: Advanced traders looking for a full-featured trading platform.

💭 Considerations: The platform may be overwhelming for novice traders due to its complexity.

Why You Should Join Logikfx

At Logikfx, we're transforming the way retail traders approach the forex market by making fundamental analysis accessible and efficient for everyone. Founded in 2013 by a small group of mathematicians and IT specialists, Logikfx has since grown into one of the world's leading forex education and analysis platforms, with over 10,000 traders benefiting from our technology today.

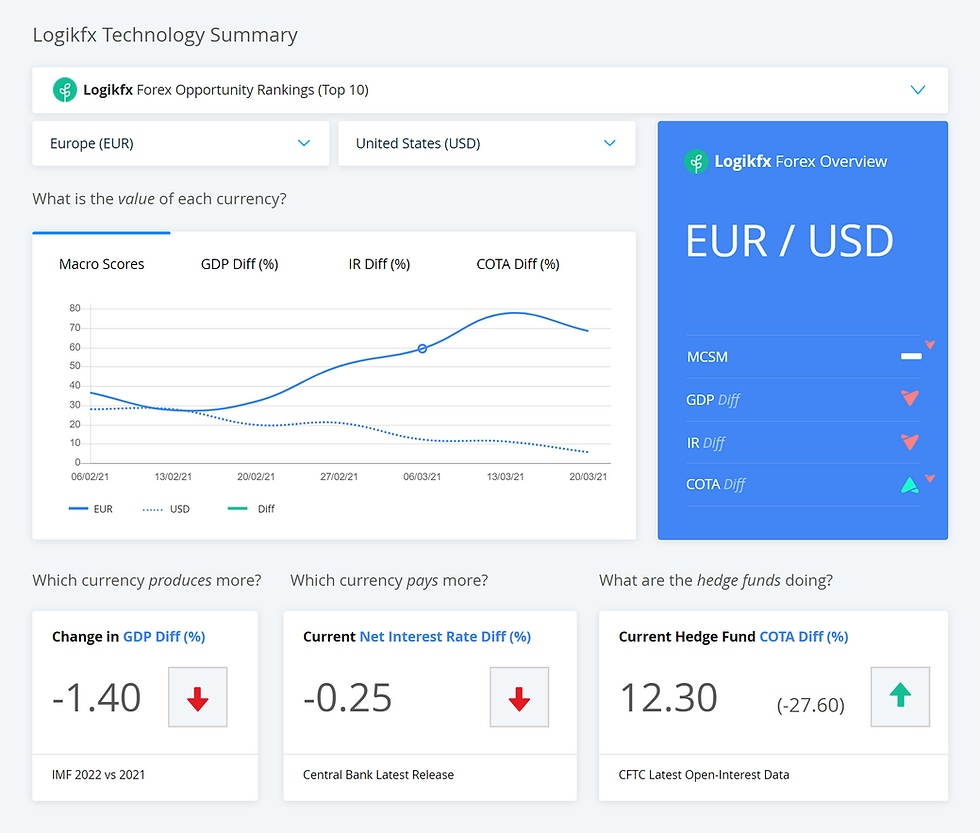

Logikfx offers a comprehensive suite of trading tools designed to save time, enhance decision-making, and minimise risk. Whether you're a seasoned trader or just starting, our tools make it easy to discover profitable trading opportunities. Our flagship technology, LITA, focuses on three critical areas: Valuation, Optimisation, and Risk Management, helping you get an all-encompassing view of the forex market.

With tools like the Forex Opportunity Rankings, Macro Currency Strength Meter, and the GDP Differential Meter, you can easily analyse fundamental data across over 35 currency pairs, comparing economic regions and monitoring interest rates to spot high-quality trade ideas. These insights, updated regularly, ensure you're always on top of market conditions.

Join Logikfx today and experience our industry-leading tools that optimise your trading performance and help you stay ahead of the curve. Our community of traders is already reaping the benefits—it's time for you to do the same!

For more information, explore our tools and join the movement at Logikfx.

Final Thoughts: Enhance Your Forex Trading with the Right Tools

By choosing the right investment app, you can simplify your trading process, whether you're focusing on stocks, forex, or other assets. With advancements in technology, these apps provide you with everything from automation to advanced charting tools, helping you make smarter, more informed decisions.

For more expert advice on trading strategies and the tools you need to succeed, check out Logikfx today!

Comments