What Is An ETF (Exchange Traded Fund)?

Updated: Apr 22, 2021

In this article we will be discussing everything "Exchange Traded Funds" or ETF's for short, we will be looking at a number of different themes such as...

What is an ETF?

Why are ETF's so popular?

The Advantages and Disadvantages of ETF's

What to look for in a successful ETF

How are ETF's regulated?

lets get stuck in!

What does “ETF” actually mean?

An exchange traded fund (ETF) is a type of security that involves investing in a pre-selected collection of stocks that often tracks an underlying index, such as the S&P 500 or the UK100.

They can be used to invest in any number of industry sectors or use various strategies.

ETFs are in many ways similar to mutual funds; however, they are listed on exchanges such a s the New York Stock exchange (NYSE) and ETF shares trade throughout the day just like ordinary stock.

A well-known example is the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index. ETFs can contain many types of investments, including stocks, commodities, bonds, or a mixture of investment types.

Just like a stock you can buy and sell an ETF within normal market hours on any exchange that offers them. they trade just like a currency or share in this way as you can send orders through either your broker or however you access the markets.

ETF’s are one of the most popular assets to trade, many have dedicated asset managers and whole teams of analysts and administrative staff, all keeping tabs on the stocks inside the ETF, making decisions every day, assessing their performance and their outlook for the next 5-10 years.

They also look for potential companies to add into the ETF or “fund” companies are either headhunted or they apply to join the fund.

Why should I invest in an ETF?

An ETF is called an exchange traded fund since it's traded on an exchange just like stocks. The price of an ETF’s shares will change throughout the trading day as the shares are bought and sold on the market.

Exchange-traded funds (ETFs) have a number of features that are ideal for smaller investors without the amounts of capital to invest seen by the hedge-funds or investment bankers. ETF’s make it possible to build a diversified portfolio. The importance of diversifying your portfolio to reduce risk is vital in any investment strategy.

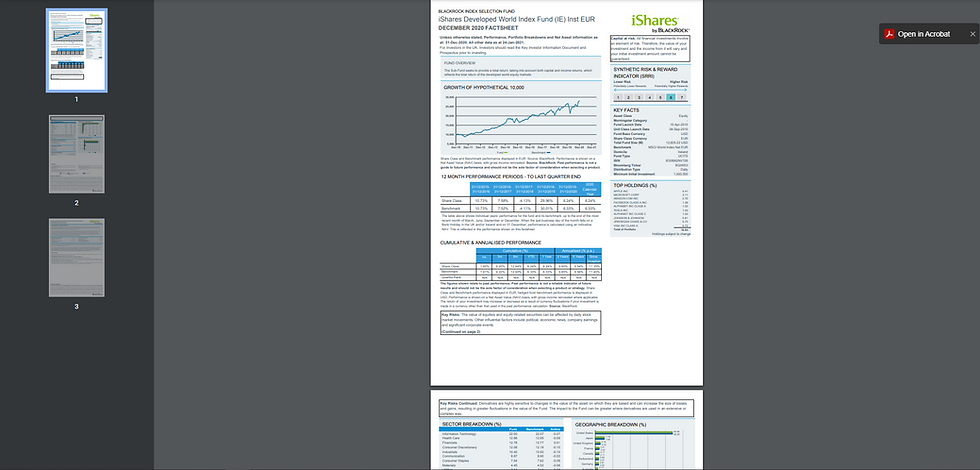

The major ETF’s are effectively a pre-built portfolio done for you by asset managers with teams of analysts and traders, most companies that run multiple ETF’s such as Vanguard or iShares will have profiles for each of their different Funds with reports, data, accounts and much more info for every single ETF that they run.

This means that before you even invest in one you can do your own analysis very easily and fit one that suits you risk.

ETF’s are normally very liquid assets – meaning they are very popular with traders, as multiple market makers or brokers compete to offer the tightest possible spreads to draw in client, much different to currency in this way, along with the diversification that you can have with any specific ETF this is a good mix of cheap entry and lower risk.

Why should I diversify my investments?

This is a core principle in any type of investing or risk management, the reason that you need to diversify your assets is to spread your risk as to protect your portfolio and, more importantly, your money if something happens to one of your investments.

To explain it better I like to think of a polar bear in ice…

Polar bears are very heavy animals – the average male weighs around 450kg!!

(yes, I did the maths)

These majestic creatures often walk over massive frozen oceans and bodies of water, and even though this ice is fairly thick, 450kg is still enough to break through… so why don’t polar bears fall through the ice?

Polar Bears are a perfect example for investors in spreading your risk, their hugely wide paws allow the to walk over even thin sheets of ice with no worries, this is due to the fact that their weight is spread over a wide surface area, meaning that in all they are less likely to fall in to the freezing water as there is no concentrated pressure on a specific part of the ice.

Relating this back to investing the reason that you should diversify is so your spread your investments over different sectors/industries, that means if for example the physical retail industry where to have a bad year, then your investments in the online retail sector would be able to contrast this and help what we call “hedge” your losses.

There is always risk with any type of investing, especially when dealing with the financial markets, however, diversification is one technique that ETF managers use to reduce this eve of risk to as low as possible.

Look out for another blog explaining this in more detail soon…

What do ETF's look like?

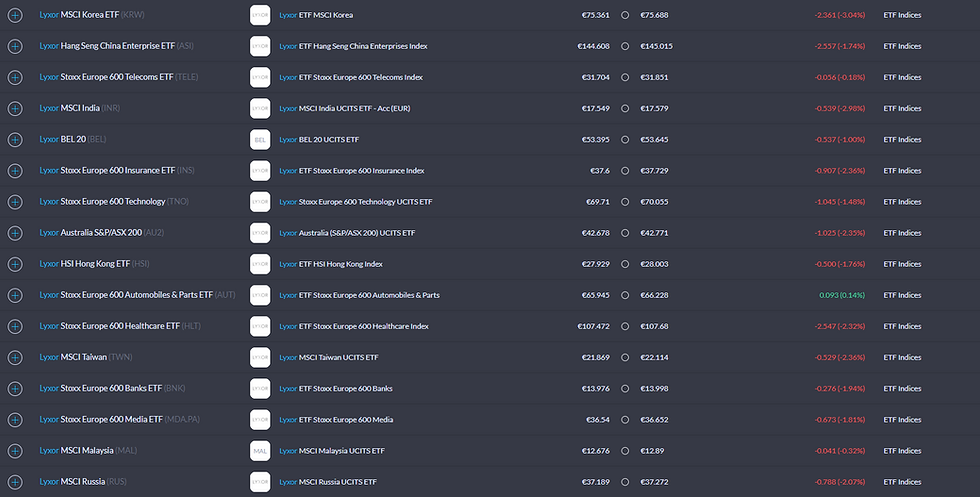

With ETF’s, one single trade can allow you to access any asset class or are of the world, to illustrate this take a look at the asset classes that investment company Lyxor provide…

Everything from European Banks to Taiwanese companies the possibilities are endless, and there are so many different investment firms out there that run ETF’s its easy to find one that you like.

This only used to be possible for big institutional but ETF’s make it accessible to anyone!

How are ETF’s regulated?

This varies depending on where you are around the world, in Europe they are regulated by the UCITS organization, ETF’s must meet certain standards that are set if they want to be available on exchanges, they must meet standards on, Diversification, transparency and liquidity.

This is very similar wherever you are trading and ensures traders are kept safe and the ETF’s aren’t doing anything untoward like mis-representing data or accepting companies shares into the ETF that are under investigation or could be seen as defrauding investors.

The Pro's of ETF's:

Done-for-you diversification:

one of the biggest challenges when getting started in the investment world is the effort and time it takes to properly hedge your portfolio, do research into different economies and companies, and accurately distribute your funds.

ETF's take away a lot of this stress, they are managed by professionals with analysts and teams behind them, they are already well built and diversifies, especially the ETF's that track a counties top companies or indices.

ETF's take a lot of the stress in terms of research and serve as a good base for any portfolio.

Information:

Similar to the point above the vast amounts of information available about different ETF's, companies like iShares will provide investor with documents indicating everything form risk factors to hypothetical scenarios, see below...

Accessibility:

One other Pro of ETF's is their availability and accessibility, as they can be traded on any exchange that offers them all traders need is a brokerage account and they will have instant access to hundreds of different ETF's.

This also means that spreads are often tight on ETF's, as they are so popular with all traders brokers often try to charge the lowest spread possible for ETF's as they are competing for customers with other brokers doing the same thing , all this competition is very good for retail traders as the tighter the spread they pay the less their profits are affected.

Con’s of ETF’s:

Trading fees:

When trading assets, it is normal to incur fees, brokers take money in different forms such as spread and commission, depending on your leverage, the amount you trade or the frequency of your trades your fees can quickly add up and hurt your profits, for an in depth look into the fees you incur read this article!

Trading fees are typically higher with ETF's than individual assets and they don’t account for spread (which is tight with ETF’s anyway) they do fluctuate depending on the type of ETF, the size of the investment company and the assets within the ETF i.e., the more valuable the stocks inside are the higher the fee i.e., emerging markets in east Africa will be cheaper than top US tech companies.

Underlying fluctuation and risks:

ETFs, like mutual funds, are often praised for the diversification they offer investors.

However, it is important to note that just because an ETF contains more than one underlying position doesn't mean that it can't be affected by volatility.

An ETF that tracks a broad market index such as the S&P 500 is likely to be less volatile than an ETF that tracks a specific industry or sector such as an oil services ETF.

Taking this into account it is vital that you analyse the fundamentals surrounding where and what the ETF is focusing on.

For example, if the ETF is top 50 UK companies then you must have a good knowledge of not only the companies I the ETF but also the UK’s economy and the state of it, if there is good scope for growth in the economy then it would be a positive bias, however, if the economy looked like it was going to shrink over the next few years then it may not be the best time to invest, it all comes down to your own appetite for risk though.

What to look for in an ETF:

1. Liquidity:

The more liquid an ETF is the easier it is to trade, that means you can buy and sell it with relative ease and without affecting price if the ETF is being traded by a good number of investors.

However, if the ETF you want to trade is not popular and has low liquidity then that could have adverse effects on your profits f you try and sell the ETF. The best way to monitor how liquid an ETF is by looking at the spreads...

If spreads are tight (small) this means that the ETF is very liquid and on the other hand, if the spreads are wide (big) that means that market makers are not competing to push this ETF meaning that there is a low level of liquidity

2. Diversification levels:

Making sure that the ETF you want to invest in is diverse is key, it allows for greater scope for growth but most importantly it will help in terms of managing the risk that comes with trading multiple different companies at the same time.

“too much of a good thing is never healthy” bear this quote in mind, if you feel as if the portfolio of the ETF is spread too thin as well this can cause issues in terms of a low level of growth in the ETF with different assets constantly cancelling each other out.

3. Research:

When looking at investing in an ETF make sure to do your own research, you can find plenty of information on the individual companies websites but also make sure that you invest some time before you invest your money.

Knowing what your getting yourself into with investing is something a lot of newbies do not do, at the end of the day, asset managers and analysts have their own opinions and you may not agree with their outlook on 1 or 2 of the companies in the ETF, and that’s ok!

There are plenty of ETF’s out there to choose from, you need to be comfortable with your own investments.

Leveraged ETFs

When it comes to risk considerations, many investors opt for ETFs because they feel that they are less risky than other modes of investment. We've already addressed issues of volatility above, but it's important to recognize that certain classes of ETFs are inherently significantly more risky as investments as compared with others.

Leveraged ETFs are a good example. These ETFs tend to experience value decay as time goes on and due to daily resets. This can happen even as an underlying index is thriving. Many analysts caution investors against buying leveraged ETFs at all. Those investors that do take this approach should watch their investments carefully and be mindful of the risks.

So make sure to do your research before investing in an ETF to make sure you understand the risks that you are taking.

Conclusion

ETF’s are great and easy ways to get started with investing in the equities market, it is key however that you know the risks involved with any type of investing, ETF’s are not risk immune they live by the index but they can jut as easily die by the index too.

Still learning how to trade? Learn through Logikfx Investment and Trading Academy (LITA) and take the first steps into growing your value as a trader with our free online courses, webinars, seminars. All from a small team of highly skilled traders with over 15 years’ experience in the financial markets. Learn how to make money trading forex, alongside the best ways to manage your risk through a proper trading journal, and sensible approaches to setting a stop loss (that doesn't get hit)!

Already know how to trade? Save hundreds of hours each month on trading technology, analysis and research using Logikfx's Macro Technology in the LITA Portal. Computing thousands of fundamental reports for over 23 economic regions, you'll know accurate currency strength at the click of a button.

Comments