What Is Spread In Forex?

- Mark Wilson

- Jan 18, 2021

- 7 min read

Welcome back to the Blog!

This week we are releasing the first of a series of blogs detailing the different ways that brokers make their money and how you can Beat the Brokers!!

In this blog we will go over...

What is spread?

How do brokers make money from spread?

What influences spread?

How to calculate the cost of spread!

The two types of spread

The Truth behind Spread!

How does spread affect my trading profits?

How do to beat the brokers!

What is spread?

Spread is the healthier alternative to regular butter, it can be used when frying or cooking vegetables, most commonly used on toast creating an undefeated combo!!

...

FOREX Spread is is the difference between the Buy and the Sell price of any given asset (varies with every broker).

In one of the most common definitions, the spread is the gap between the bid (sell price) and the ask (buy price) of a security or asset, like a stock, bond or commodity. This is known as a bid-ask spread.

Brokers will tell you that most forex currency pairs are traded without commission, but the spread is one cost that applies to any trade that you place. However, rather than charging a commission, all leveraged trading providers will incorporate a spread into the cost of placing a trade.

When a broker claims “zero commissions” or “no commission”, it’s misleading because while there is no separate commission fee, you still pay a commission. It’s just built into the bid/ask spread!

The size of the spread can be influenced by different factors, such as which currency pair you are trading and how volatile it is, the size of your trade and which provider you are using.

How do brokers make money from spread?

Brokers disguise the commissions that they take as spread, later on I will explain how they can do this!

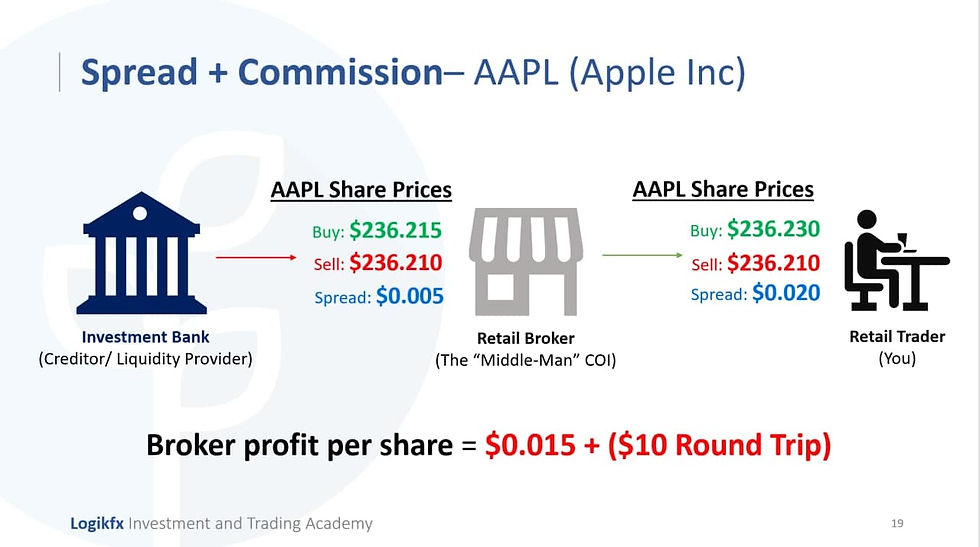

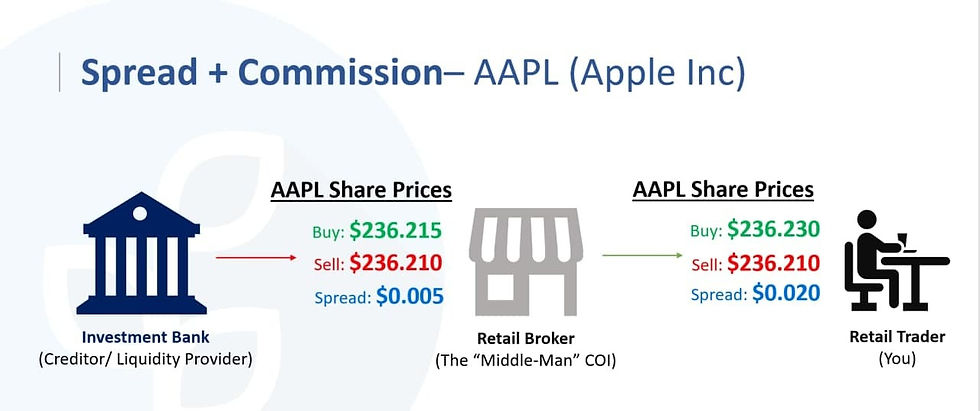

Here is an infographic that explains further how spread works

As you can see in the above example The Broker is quoting us shares for Apple (AAPL). They will buy a position from a big investment bank or other liquidity provider with a low spread quoted for them, they will then sell this position to any retail trader looking to profit of the price movement of Apples shares with a significantly higher spread!

Brokers are effectively a middle man between the liquidity provider and the trader, effectively selling you a position and making a profit, whilst also making money when you lose!

What influences spread?

Factors that can influence the forex spread include:

Market volatility

The volume of traders trading the pair

Economic news and Data releases (unemployment numbers)

Political events (elections)

Notice that these aren't mathematical indicators or complex algorithms, spread on a currency pair or share is affected by the perceived strength and popularity of the asset, and spread is set by the Dealing Desks in investment banks...

There are two main ways by which Brokers lay out their spread structure, or what influences their spread, These are called Fixed and Variable spread, depending on which one of these the broker uses will determine what influences the price of spread.

How to calculate the cost of spread!

Why do I need to know this?

You might think that spread doesn't seem like it would be significant enough to make a big difference to your trading, or, you are wondering how Brokers make so much money from a seemingly small commission, well let me explain...

Spread is always calculated in pips, however when you calculate the actual cost of spread in "$" the results are eye-opening.

For example:

Spread of 0.0004 GBP (4 pips) doesn't sound like much, but as a trade gets larger, even a small spread quickly adds up.

Currency trades in forex typically involve larger amounts of money. As a retail trader, you may use a unit size of 10,000-units of GBP/USD or 1 mini-lot. in this example the spread would not make a huge impact on your trade at £4.00

The Spread equation!

To calculate the cost of spread you will need 2 things...

The value per pip of your trade

Your lot size

To figure out the total cost, you need to multiply the value per pip by the number of lots you’re trading...

So if your lot size is 1 mini lot or 10,000 units then your value per pip will be $1 for every pip that your trade moves...

then its the simple task of multiplying these together to get your transaction cost using the equation below...

As you can see from the examples above the larger lot size you are using, the more your spread costs!

The two types of spread

In forex there are two types of spread, Fixed and Variable, in this next section we are going to cover both and why they are significant...

What is Fixed Spread?

This is spread that does not change no matter the conditions of the market, these spreads are offered by market making brokers and often the Investment banks themselves!

These are typically the biggest brokers, the market making or “dealing desk” model allows them to keep their spreads consistent and control their prices.

The Advantages of fixed spread

It is hard to find brokers that offer fixed spreads, this is because their profits can be much larger when using the next type of Spread (Variable).

If you want to know why fixed spreads will help you, look no further...

Advantages:

Predictable transaction costs

Smaller Capital requirements

More appropriate for novice traders

A volatile market will not affect the spread

Disadvantages:

Could face requotes - A requote in the Forex world means that the broker you are dealing with is not able or willing to give you a trade based upon the price you entered.

Likely to be exposed to slippage - Forex slippage occurs when a market order is executed or a stop loss closes the position at a different rate than set in the order.

What is Variable Spread?

This type of spread is where the price constantly changes depending on the conditions of the market, or the specific pair you are trying to trade.

Variable spreads are offered by non-dealing desk brokers. Brokers get their pricing of currency pairs from multiple liquidity providers and pass on these prices to the trader without the intervention of a dealing desk.

do you remember this infographic from earlier?

The above infographic explains how Brokers get their spread prices...

This means they have no control over the spreads. Typically, spreads widen during economic data releases as well as other periods where spreads will tighten when the liquidity or volume of traders in the market decreases.

For Example:

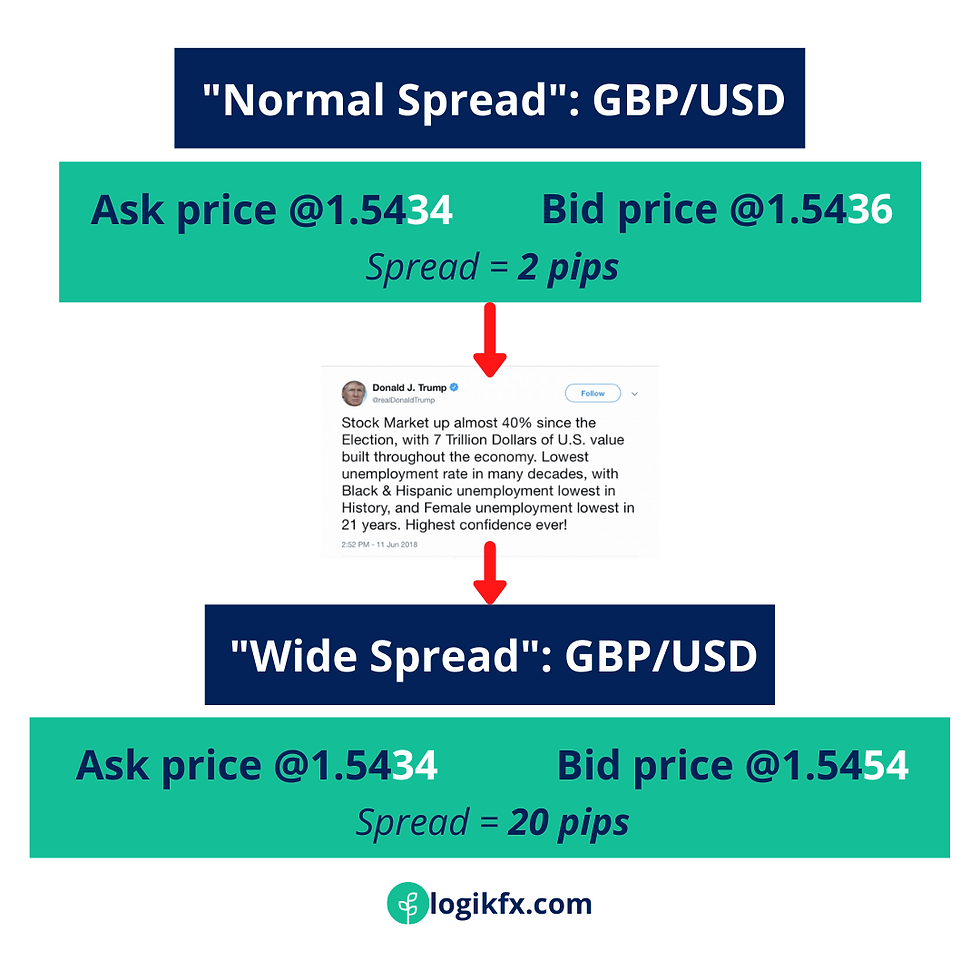

GBP/USD spreads will often widen when the US unemployment report is released, also whenever trump tweets about the dollar, this model of spread allows brokers to maximise their profits when a currency will be a popular destination for traders!

Just another way for them to squeeze every bit of money out of traders.

The Advantages of variable spread

Most brokers use variable spread as a way to maximise their profits, but what are the advantages and drawbacks for traders?

Advantages:

No risk of Requotes

Spread can be tighter than fixed

Can be a liquidity indicator

Disadvantages:

More appropriate for more experienced traders

Spread can widen rapidly if there is high volatility

Can be exposed to slippage

The Truth behind Spread!

Using variable spread brokers can inflate their commission by a lot, analysing the difference between normal and wide spread you can realise the Impact on traders.

Even though this seems like a simple topic there is a shocking truth to the difference between normal and wide spread.

As you can see whenever a pair will be popular they will increase spread exponentially, severely hindering any profits that you can make as a trader.

When spread widen to over 10 pips this will impact you positions a lot, if we take our equation from earlier and apply it to a scenario when GBP/USD is highly volatile we can see this...

How does spread affect my trading profits?

Just like VAT on a car or a Delivery fee on an UberEats Maccies order

Disclaimer: this blog is not sponsored by either brand... however we are open to the idea :)

Spread is like a cost added on to your trade position, it automatically puts you in a losing position no matter how good your bias or technical analysis

Even though the difference is often small in periods of high volatility if you trade with a broker that uses variable spreads as large as 20 pips or 0.2% it can severely hinder your trade in the short term.

When working out the cost of your spread as shown above, take this information into account, it may be cheaper to sell than buy.

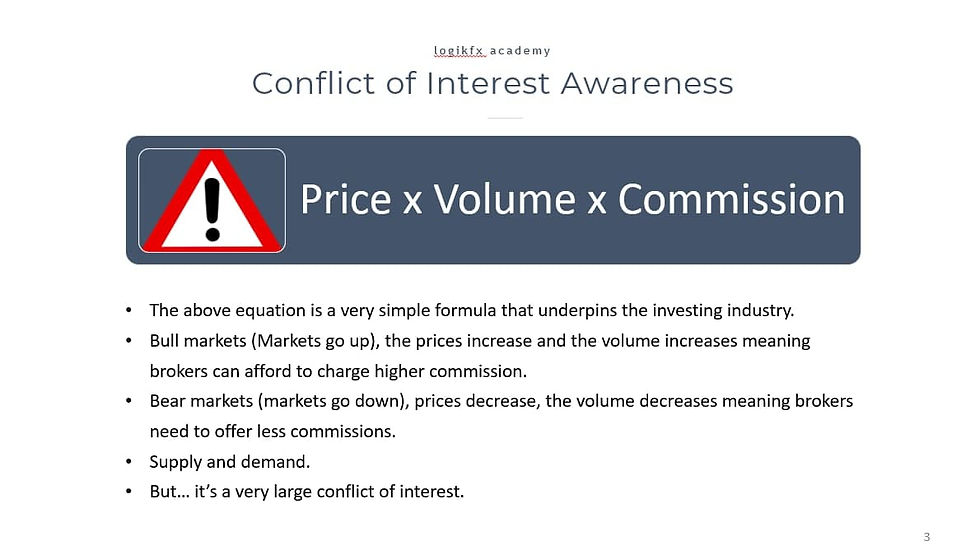

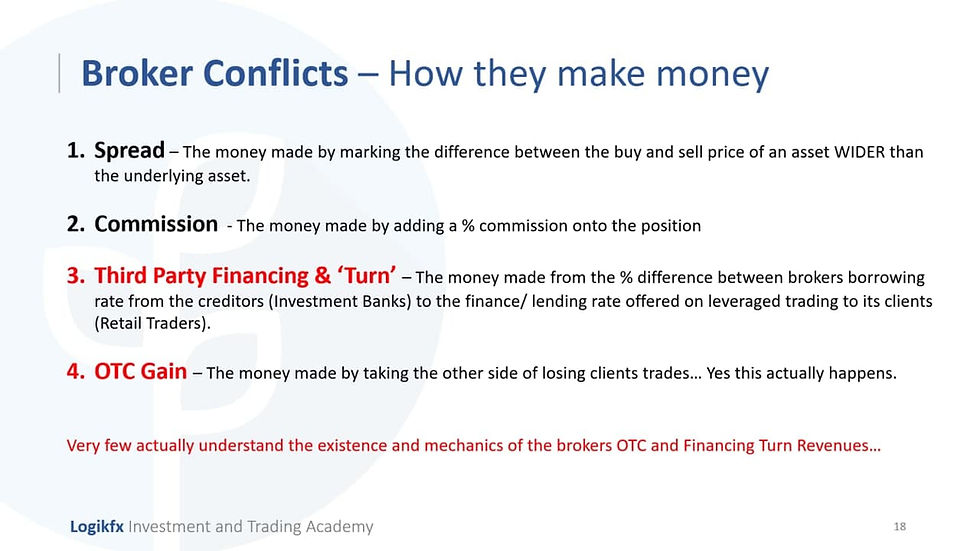

How do Brokers make their money?

As explained in our position sizing blog brokers can make their money a variety of ways, they are geared up to make money off of the losers mainly, as there are way more losers than winners in forex trading.

Spread is just one way they make money… we will be diving in depth over the next few weeks with blogs and videos on the different ways that brokers make their money that are shown in the graphic above.

How do to beat the brokers!

This is why we at logikfx adopt the long term approach…

The best way to beat spread is to nullify its effects on your profits as much as you can, day traders and most retail traders that trade short term are affected by spread on a daily basis.

They are always having to worry about its affects as they need to make profit quick spread has a bigger impact.

Trading or investing long term allows you to relax about spread, as long as your fundamentals are strong.

You will be confident that once you pay the spread your bias has plenty of time to follow through so you do not need to worry about big costs or volatility on a daily basis as your bias will be carried out over a number of weeks, allowing you plenty of time to recover the spread.

Still learning how to trade? Learn through Logikfx Investment and Trading Academy (LITA) and take the first steps into growing your value as a trader with our free online courses, webinars, seminars. All from a small team of highly skilled traders with over 15 years’ experience in the financial markets. Learn how to make money trading forex, alongside the best ways to manage your risk through a proper trading journal, and sensible approaches to setting a stop loss (that doesn't get hit)!

Already know how to trade? Save hundreds of hours each month on trading technology, analysis and research using Logikfx's Macro Technology in the LITA Portal. Computing thousands of fundamental reports for over 23 economic regions, you'll know accurate currency strength at the click of a button.

Hi everyone, are you looking for a professional binary, forex and Bitcoin broker/manager who will guide and help manage your trade and help you earn meaningful profits all within seven days? Contact Mr Barry Silbert now for your investment plan. For he has helped me to earn 10,250 USD just with a little investment capital and with the aid of his trading software system that brings forth good trading signals i was able to trade and cash out on time and am still trading with him, if you need his assistance on how to recover your lost investment in bitcoin/binary Contact him now on whatsaap +447508298691. or contact him on his email address Email: Barrysilbert540 @ gmail. com. [WITH MR…